Montana Medical Care Savings Accounts (MSAs) for the 2024 Tax Year

MT199817HR

Revised May 2024

by Marsha A. Goetting, Ph.D., CFP®, CFCS, Family Economics Specialist, MSU Extension; Keri Hayes, MSU Extension Economics Program Assistant

THE MONTANA MEDICAL CARE SAVINGS ACCOUNT ACT allows Montanans to save money for medical expenses and long-term health care while

reducing their state income taxes.

While the term “medical care savings account” implies the use of a savings account,

a checking account or certificate of deposit is also permitted. Stocks, bonds, and

mutual funds are also allowed investments for an MSA. Before selecting the type of

investments for an MSA, individuals should consider how liquid the account is at the

time they expect to need it for eligible medical expenses (listed on page 2). For

example, most people would not want to sell their stocks when the market is down to

pay for medical expenses.

An MSA must be separate from other accounts and only the account holder can have access

to the funds. Joint accounts for MSAs are not allowed. A spouse must establish a separate MSA. The money deposited in an MSA is not subject

to Montana income taxation while in the account or if used for eligible medical expenses

for the account holder or anyone else the account owner chooses. An account holder has until January 15 to make a withdrawal for an expense paid in

the prior tax year. If an account holder does not use money placed in an MSA during the year deposited,

it remains in the account. The account continues to earn interest and dividends without

Montana income taxation. If the funds are used for eligible medical expenses in future

years the withdrawals are not subject to Montana income taxation.

Who is eligible for an MSA?

All resident taxpayers aged 18 and older are eligible to set up a Montana MSA even

if they have another health care plan provided by their employer, or a Section 125

(Flexible Spending Account) or a federal Health Savings Account (HSA). A taxpayer

does not have to be in a “high deductible” health insurance plan to be eligible for

an MSA as they do for the Heath Savings Account (HSA). An MSA cannot be established

for a minor child under age 18. However, parents can use their MSA to pay for eligible

expenses for a minor child, as well as children over the age of 18.

Is “earned” income required to deposit to an MSA?

No. Earned income is required for deposits to Individual Retirement Accounts (IRA)

except for deposits to spousal IRAs.

Who is eligible to use funds from an MSA?

Formerly, funds in an MSA could only be used by an account holder for their parents,

spouse, and children. As of January 1, 2018, money in an MSA can be used to pay eligible

medical care expenses not only for the account holder, but also for ANYONE the account holder chooses.

What is the limit on a contribution to an MSA?

The maximum amount a Montanan can contribute to an MSA is $4,500 during 2024. The

amount contributed is used to reduce income resulting in a lower state tax. After

December 31, 2024, the MSA contribution limit will be increased annually by the rate

of the Consumer Price Index rounded to the nearest $100 increment.

A person can also put less than the limit of $4,500 in an MSA. If the money is left

in the MSA (or withdrawn for eligible medical expenses), the amount is not subject

to state income taxation. The amount used to reduce income for state income tax purposes

is the total amount deposited in the MSA during the tax year – not the amount withdrawn

for eligible medical expenses. A similar reduction in income, however, is not allowed

for federal income tax purposes. Montana has no limitation on the amount of funds and interest that may be accumulated

tax-free within an MSA.

Note: All examples within this MontGuide use the MSA limit for the 2024 tax year of $4,500.

Example (single person): Barbara, a county employee, established an MSA at a local bank and deposited $4,500

in the account on January 31, 2024. During the year, she had $2,500 in eligible medical

expenses. On Barbara’s Montana Individual Income Tax Return, her taxable income of

$59,000 is reduced by her $4,500 MSA contribution, not the $2,500 she withdrew for

eligible medical expenses.

The remaining $2,000 in Barbara’s MSA will continue to earn interest and is available

to be withdrawn for eligible medical expenses in future years. However, Barbara cannot

use the remaining $2,000 as a reduction of income in a future tax year. Barbara’s

Montana taxable income for the present tax year is $54,500 ($59,000 - $4,500 = $54,500).

Her Montana income tax will be based on $54,500, less allowable deductions. Barbara’s

federal income tax will be computed on her federal adjusted gross income of $59,000,

less any allowable deductions.

What medical expenses are eligible for an MSA?

Money withdrawn from an MSA is NOT subject to Montana income tax if used for either

of these two basic purposes of paying medical expenses or purchasing long-term care.

1. Paying eligible medical expenses of the account holder or anyone the person chooses.

The Montana Department of Revenue accepts eligible medical expenses as defined under

the Internal Revenue Code Section 213 (d). These are the same expenses that are allowed

as itemized deductions for federal income tax purposes such as:

- Medical insurance premiums

- Medicare A premiums: If you are not covered under Social Security (or were not a government

employee who paid Medicare tax) and you voluntarily enroll in Medicare A, the premiums

paid for Medicare A are eligible medical expenses for a Montana MSA.

- Medicare B premiums

- Medicare D premiums

- Medigap insurance premiums

- Prescription drugs

- Insulin

- Medical and dental expenses

- Nursing care

- Eyeglasses and contact lenses

- Crutches

- Hearing aids

- Transportation for medical care

- Allowable lodging expenses

- Deductible amount and co-payments not covered by other types of health insurance

- Face masks and other personal protective equipment to prevent spread of COVID-19

A list of eligible medical expenses for a Montana MSA is available in IRS Publication 502, “Medical

and Dental Expenses.” The publication may be printed from the IRS website at www.irs.gov/pub/irs-pdf/p502.pdf.

In addition to the items allowable for a federal itemized deduction, MSA funds can

also be used for the following expenses:

- Family leave expenses. A family leave expense includes:

- premiums paid for family leave insurance.

- the amount of wages lost while caring for a family member under the federal Family and Medical Leave Act (FMLA). The wage expense is calculated monthly by multiplying the hourly wage the caregiver would have been paid by the number of hours typically spent working but were instead used for caring for parents, spouse, or children. The result is divided by 12. The Montana Department of Revenue considers the hourly wage for a person paid a salary is the gross annual wage divided by 2,087.

- Any fees associated with a direct patient care agreement.

- Healthcare sharing ministry payments. The healthcare sharing ministry must be considered

a healthcare sharing ministry under Montana law.

2. Purchasing long-term care insurance or a long-term care annuity for the long-term care of the MSA holder or anyone chosen.

The Montana Department of Revenue also accepts the purchase of long-term care insurance

as an eligible medical expense for the account holder or for anyone else the account

holder chooses. The purchase of a long-term care annuity is also an eligible medical

expense for the MSA holder or anyone the person chooses.

Each account holder must maintain documentation of eligible medical expenses for a

minimum of three years from the date the account holder filed a Montana income tax

return for the year the expenses were incurred.

Note: medical providers do not need to be paid directly from the account, but supporting

documentation of medical expenses and payment is required. For further information,

MSU Extension MontGuide “Long-Term Care Partnership Insurance in Montana” (MT201202HR),

is available from the local Extension office or online https://store.msuextension.org/Products/Long-Term-Care-Partnership-Insurance-in-Montana__MT201202HR.aspx.

What expenses are not eligible for an MSA?

Money held in an MSA may not be used to pay any medical expenses that have already

been reimbursed under some other type of insurance coverage.

Example (single family): Amy established an MSA at a local credit union and deposited $4,500 in the account

on January 10, 2024. During the year, she had medical expenses of $1,400. Her insurance

covered 40 percent of medical expenses ($1,400 x 0.40 = $560). The amount not covered

by insurance was $840 ($1,400 – 560 = $840). She decided to use her MSA to pay for

the balance of $840 in medical expenses. Amy now has $3,660 left in her MSA to carry

over to the next year ($4,500 - $840 = $3,660).

On her 2024 Montana tax return Amy reduces her Montana income by $4,500, the total

amount she deposited in her MSA. In 2025, Amy didn’t deposit any money into her MSA,

since she believed the $3,660 in the MSA would cover any added medical expenses not

covered by insurance in 2025. Because Amy did not deposit any money to her MSA in

2025, she does not receive any MSA reduction of income on her 2025 Montana income

tax return.

Other types of reimbursable items that do not qualify as eligible medical expenses

under the Montana MSA law include medical expenses payable under an automobile insurance

policy; workers’ compensation insurance policy; or a self-insured plan; federal HSA

payment; Section 125 (Flexible Spending Account FSA) or medical expenses covered under

a health coverage policy, certificate, or contract.

If you are covered by Social Security (or if you are a government employee who paid

Medicare taxes), you are enrolled in Medicare A. The payroll tax paid for Medicare

A is not an eligible medical expense for a Montana MSA.

A list of ineligible medical expenses for a Montana MSA is available in IRS Publication 502, “Medical

and Dental Expenses.” The publication may be printed from the IRS website at www.irs.gov/pub/irs-pdf/p502.pdf.

What if a person doesn’t have $4,500 to deposit in an MSA?

One Montanan “parlayed” smaller amounts until she reached the maximum of $4,500. She

first deposited $300 to open an MSA, and then withdrew $200 for eligible medical expenses.

Then she deposited $200 and repeated that until her total deposits by the end of the

year reached $4,500. It’s the amount deposited in the MSA that provides the tax break.

Example: Carly and Bruce cannot afford to place $1,000 in an MSA, much less $4,500. However,

Carly realized she could afford to put in $400 in an MSA in January. During that month

her family had $300 of eligible medical expenses. She saved documentation for the

expenses and took $300 out of her MSA. She then immediately redeposited the amount

in her MSA. She has now deposited a total of $700.

Carly intends to add small amounts to her first $400 deposit to reach a total of $4,500

by the end of the year because she has realized through the years her family usually

has annual medical expenses of more than $4,500. However, Carly needs to be careful

not to withdraw more than she has spent in eligible medical expenses.

How much will a person save on Montana income tax with an MSA?

A Montana taxpayer’s taxable income is reduced by the amount annually deposited to

the MSA. The maximum amount can be up to $4,500 for single filers and up to $9,000

total for married couples (2024). As a result of a reduction in income, there is a

reduction in the Montana income tax due. The amount of reduction in Montana income

taxes depends on the account holder’s tax rate. For information about Montana tax

rates, go to https://montana.servicenowservices.com/citizen?id=kb_article_view&sysparm_article=KB0014487 .

To determine approximately how much your Montana income tax would be reduced, multiply

the amount deposited in your MSA by the tax rate for your taxable income. For example,

in 2024 a Montanan using the single filing status with taxable income of more than

$20,500 had a 5.9 percent income tax rate (married filing status more than $41,000

in taxable income is 5.9%). Eligible medical expenses paid with MSA funds cannot be

deducted elsewhere on the Montana income tax return.

Example (married couple): Rob and Sheila, owners of a downtown business, deposited $4,500 each in an MSA with

a mutual fund in March 2024. Their deposits lower their Montana taxable income by

$9,000. They have a 5.9 percent Montana state income tax rate. Their MSA deposits

saved them approximately $531 in Montana income taxes for the 2024 tax year ($9,000

x .059 = $531).

How much will a person save on federal income taxes with an MSA?

Nothing. The amount deposited to a Montana MSA is not eligible for a reduction in

income on the federal tax return. However, if a person has medical expenses exceeding

7.5 percent of federal adjusted gross income in 2024 and the person itemizes using

Schedule A, that amount can be deducted. However, with the federal standard deduction

at $29,200, few have enough itemized expenses to benefit from the deduction.

Example (married couple): Ben and Bethany have an adjusted gross income of $55,000. Any medical expenses they

could deduct on their federal return in 2024 must be above $4,125 ($55,000 income

x 0.075 to exceed federal adjusted income = $4,125). Because their medical expenses

that were not covered by health insurance amounts to $3,100, they are not allowed

a medical deduction on their federal return. However, because Ben and Bethany set

up Montana MSAs in 2024 with a contribution of $4,500 each, they can reduce their

Montana taxable income by $9,000 even though their withdrawals for eligible medical

expenses totaled $3,100.

How much interest will an MSA earn?

Money in an MSA can earn interest similar to money deposited in other savings, checking,

and investment accounts at financial institutions. The rate of interest is determined

by the financial institution where the MSA is established. The interest earned or

the investment gains on an MSA are not subject to Montana income tax if they are left

in the account or if they are withdrawn for eligible medical expenses. MSA earnings

(interest and dividends), however, must be declared on the Federal income tax return.

Which is best to place money into, an MSA, FSA or HSA?

The amount placed in an FSA can also be used to reduce an individual’s state and federal income. The challenge Montanans face is they must typically decide a year ahead of time how much they anticipate paying in medical expenses during the next year that will not be covered by their health insurance policy. Any amount not used is forfeited. The “use it or lose it” phrase is often used to describe FSAs. However, a recent change in federal regulations allows for up to $500 in an FSA to be rolled over to the next year.

Example (single person): Becky decided to set aside $200 per month ($2,400 during the year) in her FSA. Unfortunately, she had used up all $2,400 by July because of uncovered physical therapy expenses. From July to December, she had another $4,500 in eligible medical expenses. She opened an MSA to cover those expenses and was able to reduce her Montana income by a total of $6,900 ($2,400 for the FSA + $4,500 for the MSA = $6,900 in 2024). Becky’s federal income was reduced by the $2,400 that was set aside in her FSA with a resulting $528 in federal income tax savings. Becky’s Montana income was reduced by the $2,400 she set aside in her FSA and the $4,500 deposited in her MSA for savings in Montana income taxes of $407.10 ($2,400 + $4,500 = $7,900 x .059 = $407.10).

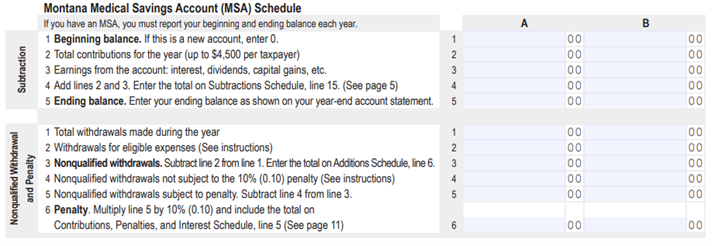

How is an MSA reported on the Montana tax return?

The total amount contributed to an MSA deposit (up to $4,500 for an individual) is entered as a reduction on the Montana Individual Income Tax Return. For example, on Form 2, page 5 for the year 2023, the amount deposited between January 1 and December 31, 2023, was entered on line 15 (this line number could change from year to year). At the bottom of Form 2, page 3, appears the MSA Schedule (Figure 1). On it, enter the beginning balance on line 1 and the ending balance on line 5.

MSA earnings are reported on the financial institution’s 1099 form sent to the account holder and to the Internal Revenue Service (IRS). Some financial institutions send a 1099 form for each MSA account. Others may include the MSA interest and investment gains in a total with other interest and investment accounts.

Figure 1: Montana Medical Savings Account (MSA) Schedule (2023) (may change in 2024)

Closely examine a 1099 to deduct only the proper amount on the MSA earnings from the account line on the Montana Medical Care Savings Account Schedule. ALL MSA interest and investment gains must be declared on a federal income tax return.

Who administers an MSA?

Montana law provides that an MSA can be administered by the individual account holder

(self-administered), or a registered account administrator. Regardless of the type of administration

selected, the account holder is required to maintain documentation to verify MSA funds

are used exclusively for eligible medical expenses.

Self-Administered Account Holders. Almost all Montana MSAs are self-administered. The MSA may be established with a

financial or other approved institution (e.g., banks, credit unions, mutual fund companies,

etc.) A self-administered MSA must be kept separate from all other accounts. The account

must be maintained specifically for eligible medical expenses for the individual account

holder or anyone the account holder chooses.

A self-administered account holder must fill out the Montana Medical Care Savings

Account Schedule on Form 2, the Montana Individual Tax Return (available from Department

of Revenue). https://mtrevenue.gov/wp-content/uploads/dlm_uploads/2023/12/Form_2_2023.pdf.

Can an employer contribute to an MSA for an employee?

Yes, from the state perspective, an employer can contribute up to $4,500 to an employee’s

MSA. These contributions are considered wages to the employee, but are still exempt

from Montana tax. The employee would subtract the amount of the employer’s contribution

on that year’s Montana income tax return. From the federal perspective, if an employer

establishes an MSA for an employee, the amount would be a business expense to the

employer. The employer would include the $4,500 as part of the employee’s wages and

report the amount on their W2 form. The amount of contribution would be taxable on

the federal return. When the employee files a federal income tax return, the deposit

would be included as wages on their 1040 form.

Example: In 2024 the Bobcat Corporation placed $4,500 in their employees’ MSAs. This means Bobcat Corporation includes the $4,500 in the employees’ W2 form for 2024. The $4,500 is included as wages on the employees’ 1040 form.

What fees are charged to establish and maintain an MSA?

Ask the institution if they have any type of maintenance or service fees for MSAs.

For example, one financial institution charges a $1 fee per withdrawal for more than

six withdrawals made in a month. Another institution may not charge a service fee

if the account holder maintains a $300 minimum balance. When the account drops below

the $300 minimum, there is a fee of $2 for each month the balance is below the minimum.

Maintenance fees are eligible expenses to withdraw from an MSA. Some institutions

offer free checking for MSAs for depositors aged 50 and older.

- An MSA holder can withdraw MSA money on the last business day in December, even if the money is not used for eligible medical expenses. If the funds were excluded

on a prior return, the amount withdrawn is included as ordinary income for Montana

tax purposes.

Example: Thomas, a farmer, established an MSA in March 2024 with $4,500. He did not have any medical expenses during the year so his $4,500 carried over to 2025. On the last business day of the year in 2025, Thomas withdrew $4,500 from his MSA to use for unexpected repairs on his combine. Because Thomas did not use the withdrawal for eligible medical care expenses, his Montana taxable income for 2025 increased by $4,500. However, Thomas did not have to pay a 10 percent penalty because he withdrew the $4,500 on the last business day of the year. - A withdrawal upon the death of an account holder is not subject to the 10 percent penalty. The amount withdrawn, however, is added

to the decedent’s Montana income for the tax year in which the death occurred, unless

the account passed to an eligible beneficiary. The withdrawal is considered taxable.

- The transfer of funds from one MSA to another MSA, such as a different type of investment (from a savings account to a certificate

of deposit within the same financial entity) or a different financial institution

(from a savings account in a bank to a mutual fund company) is NOT considered a withdrawal

and therefore is not subject to the 10 percent penalty.

Example: Warren has an MSA at his local bank. The MSA has grown to $12,000. He has decided to transfer $9,000 to a certificate of deposit MSA so he can earn a higher rate of interest. Warren requested the bank transfer $9,000 to a CD designated as an MSA. He has $3,000 remaining in his savings account MSA. When the CD matures, he can renew it at the prevailing interest rate or he can direct the bank to transfer the balance to his MSA savings account so he can use the funds for eligible medical expenses. - A person can be reimbursed from their MSA for eligible medical expenses paid, even if the expenses were charged on a credit card. A person has until January 15 of the next year to withdraw the funds from an MSA to reimburse themselves for the credit card charges. However, the MSA account must have already been set up between January 1 and December 31 of the prior year.

How is a penalty reported?

Self-administered account holders who make withdrawals from an MSA that were not used

to pay qualifying medical expenses must report the amount on the MSA Schedule available

on Form 2, page 3 (2024). The money withdrawn is considered ordinary income for Montana

income tax purposes. The MSA schedule can be found on the Montana Individual Tax Return

at: https://mtrevenue.gov/publications/montana-individual-income-tax-return-form-2/.

What happens to an MSA upon death of the account holder?

When an account holder dies, Montana law provides a legal procedure for distributing

the money remaining in the deceased’s MSA. The Personal Representative for the estate

may withdraw funds for eligible medical expenses incurred by the deceased (within

one year after the death of the account holder).

Account Administrator. If the deceased person’s MSA is with an account administrator, they are responsible

for distributing the principal and accumulated interest in the account to the estate

of the account holder or to a designated payable-on-death (POD) beneficiary or transfer

on death registration (TOD) beneficiary. This action should be completed within 30

days of the financial entity being furnished proof of the death of the account holder.

If there is no POD or TOD, the amount remaining in the MSA is distributed to the estate

of the deceased. The amount then passes to devisees (beneficiaries) in a written Will

or to heirs under Montana’s intestacy statutes. See the MSU Extension MontGuide “Dying

Without a Will in Montana” (MT198908HR), available from the local Extension office,

or online at https://store.msuextension.org/Products/Dying-Without-a-Will-in-Montana-MT198908HR__MT198908HR.aspx.

Self-Administered Account. The personal representative appointed by the district court is responsible for notifying

the financial entity of the death of the MSA account holder.

An account holder can leave the balance in the MSA to anyone or to an immediate family

member: parent, spouse, or child through a payable on death designation (POD) or transfer

on death registration (TOD), by a written Will. If no Will was written or a POD or

TOD was not designated, the MSA is distributed by the signed account agreement. However,

only parents, a spouse, or children who are residents of Montana may receive the balance

as an MSA to be added to their MSAs or to establish one.

The transfer must take the form of a direct transfer. A direct transfer can be made

using an electronic bank transfer or a check, not cash. If the MSA funds are transferred

into funds of a regular account, instead of an MSA there is a loss of the state income

tax benefits for the transferred MSA funds.

The transfer of funds in the MSA to eligible beneficiaries in Montana or out-of-state

is not included in their gross income. The ending balance of the MSA is reported on

Montana Form 2, Schedule MSA, line 5 (may change after 2024).

Example: Don named his wife as a POD beneficiary of his MSA with a balance of $7,000. After

his death, his wife had the bank make a direct transfer of the $7,000 to her MSA without

the amount being considered income to her or Don for Montana income taxation purposes.

The funds from an account of a deceased account holder distributed to heirs who are

NOT an immediate family member, are considered nonqualified withdrawals and the amount

is recaptured on the income tax return of the estate. However, there is no penalty

to the estate for this nonqualified type of withdrawal.

Who are eligible beneficiaries for MSA funds?

Eligible beneficiaries include a spouse, parents, and children. The recipient must

be a Montana resident and receive the money in an already established MSA or an MSA

created with the transferred MSA funds.

What if beneficiaries live out-of-state?

If an MSA is passed to children or parents who live in Montana, they are allowed to

deposit the funds in an MSA so there is no tax impact. If MSA funds pass to nonresident

children or parents, then the amount is subject to Montana income taxes in the year

of death. The decedent’s income tax return would declare the MSA balance as income.

If the deceased had more than $21,600 in income, then the tax rate is 5.9% (2024).

Example: Phyllis had an MSA balance of $24,000 when she died. She had placed a POD on the

account designating the $24,000 to be divided among her four children. Only one daughter,

Sheila, lives in Montana. Shelia will receive ¼ of the MSA funds of Phyllis ($6,000)

as an MSA. The remaining $18,000 ($24,000 – 6,000 = $18,000) is subject to Montana

income taxes on Phyllis’s final income tax return. Her income was $50,000. To that

amount is added the remaining $18,000 of the MSA passing to her out-of-state children.

The estate of Phyllis would pay an additional $1,062 in Montana income tax for the

MSA amount passing to Phyllis’s three out-of-state children.

What happens to the balance in an MSA if POD or TOD beneficiary isn’t designated?

If a payable on death designation (POD) or transfer on death registration (TOD) beneficiary

is not named, the money in the MSA is distributed according to the account holder’s

written will, or the signed agreement or Montana intestacy statutes if the person

has no written will.

Example: In her will, Gayle named her three daughters in Montana as beneficiaries of her

MSA with a balance of $9,000. After Gayle’s death, the personal representative transferred

$3,000 to each of their MSAs without the amount being considered income for Montana

taxation purposes either for Gayle’s estate or her three daughters.

Example: Rick, a bachelor, died without a will. All his relatives live outside Montana. The

personal representative of his estate filed a Montana Income Tax Return for Estates

and Trusts (Form FID-3) and declared the $20,000 remaining in Rick’s MSA as income

for Montana tax income purposes.

What happens to an MSA if the owner becomes incapacitated?

If an account holder becomes incapacitated, no one can withdraw the funds unless a

financial power of attorney is given to another individual or unless conservatorship

is granted by the district court to another individual.

The financial power of attorney is a written document in which a person gives another

person legal authority to act on their behalf for financial transactions. For additional

information, request the MSU Extension MontGuide “Power of Attorney (Financial)” (MT199001HR),

available from the local Extension office, or online at: https://store.msuextension.org/Products/Power-of-Attorney__MT199001HR.aspx.

What happens to my MSA if the account holder moves from Montana?

If an account holder moves from Montana to another state or country and has unused

MSA funds, those unused funds are considered nonqualified withdrawals. The funds must be declared as income on the final Montana Income Tax Return, Form

2, MSA Schedule. The 10% penalty can be avoided by making the withdrawal for the remaining

balance in the MSA on the last business day of the year.

MSA Planning Technique

Montana taxpayers who are not sure if they will have eligible medical expenses during

the year can wait until the last business day in December to open an MSA.

Example: Matt kept documentation of his medical expenses not covered by his health insurance policy throughout the year and found they totaled $5,500. On the morning of December 30, 2024, he transferred $4,500 from his regular savings account to establish an MSA. The next day (the last business day of the year), he withdrew $4,450 from the MSA and placed the funds back into his regular savings account. Matt left $50 in the MSA account to keep it active. Matt can reduce his Montana income by the $4,500 he deposited into his MSA even though the money was only in the account for less than 24 hours. On his Montana income tax return, he reported $4,500, the amount he deposited, on Form 2, page 5 line 15 (may change in future years).

Summary

The Montana Medical Care Savings Account Act allows a Montana taxpayer to establish

an MSA and deposit up to $4,500 in 2024. The increase for 2025 and beyond is determined

by the Department of Revenue (DOR). The DOR will multiply $4,500 by a ratio of the

Consumer Price Index (CPI) from June 2023 and the CPI for the previous June. The result

is rounded to the nearest $100 increment.

If principal and earnings are withdrawn for payment of eligible medical expenses or

for long-term care of the account holder or anyone else, then the amounts are excluded

from the owner’s Montana state income tax. However, only the interest earnings or

investment gains are subject to taxation at the federal level.

Withdrawals from an MSA for any purpose other than eligible medical expenses are treated

as ordinary income in Montana and taxed accordingly. Withdrawals are subject to a

10 percent penalty unless the withdrawal falls under the exceptions listed in this

guide. An MSA can be managed by an account administrator or self-administered by the

individual account holder. Most accounts in Montana are self-administered.

Further Information

If you have questions or need additional information about Montana Medical Savings

Accounts, contact:

Montana Department of Revenue

P. O. Box 5805

Helena, MT 59604-5805

Telephone: 406-444-6900

https://mtrevenue.gov/

Marsha A. Goetting, Ph.D., CFP®, CFCSExtension Family Economics Specialist

P. O. Box 172800

Montana State University Bozeman, MT 59717

Telephone: 406-994-5695

E-mail: marsha.goetting@montana.edu

Montana Individual Tax Return

https://mtrevenue.gov/publications/montana-individual-income-tax-return-form-2/

Acknowledgements

This MontGuide has been reviewed by representatives from the following:

- Montana’s Credit Unions

- Montana Department of Revenue

These organizations recommend its reading by those who want to know more about MSAs.

Disclaimer

This MontGuide is based on Montana law and Administrative Rules in effect as of the

date of printing. The information presented is for informational purposes only and

should not be considered as tax or legal advice or be used as such. For answers to

specific questions about MSAs, readers should confer with appropriate professionals

(certified public accountants, attorneys, and certified financial planners).

To download more free online MontGuides or order other publications, visit our online catalog at https://store.msuextension.org, contact your county or reservation MSU Extension office, or e-mail orderpubs@montana.edu.

Copyright © 2024 MSU Extension

We encourage the use of this document for nonprofit educational purposes. This document

may be reprinted for nonprofit educational purposes if no endorsement of a commercial

product, service or company is stated or implied, and if appropriate credit is given

to the author and MSU Extension. To use these documents in electronic formats, permission

must be sought from the Extension Communications Director, 135 Culbertson Hall, Montana

State University, Bozeman, MT 59717; E-mail: publications@montana.edu

The U.S. Department of Agriculture (USDA), Montana State University and Montana State University Extension prohibit discrimination in all of their programs and activities on the basis of race, color, national origin, gender, religion, age, disability, political beliefs, sexual orientation, and marital and family status. Issued in furtherance of cooperative extension work in agriculture and home economics, acts of May 8 and June 30, 1914, in cooperation with the U.S. Department of Agriculture, Cody Stone, Director of Extension, Montana State University, Bozeman, MT 59717.